Boy Abunda introduces new mobile wallet app ‘Sendwave’ for kababayans here and abroad

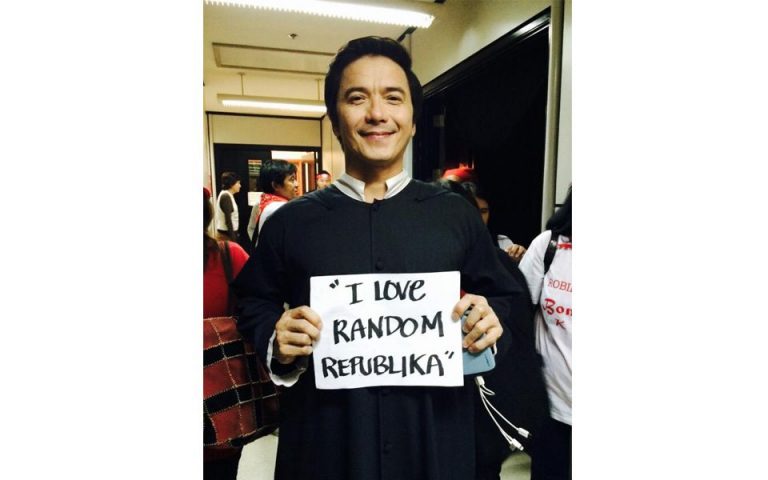

He is back! The King of Talk Boy Abunda is back in the endorsement scene with a new product that will surely benefit both our kababayans here and abroad.

If Tito Boy asks you, would you rather have s*x or chocolate? But what if you could choose between cash or chocolate? Thanks to a mobile wallet app that has been churning out satisfied customers for the past year in the Philippines, you don’t have to choose — you can have both cash AND chocolates!

Sendwave is a new app to help overseas foreign workers and Filipinos living abroad send more of their hard-earned money back home. Now the King of Talk is helping spread the word to make sure all Kababayan know about the revolutionary app that sends money quickly and fee-free.

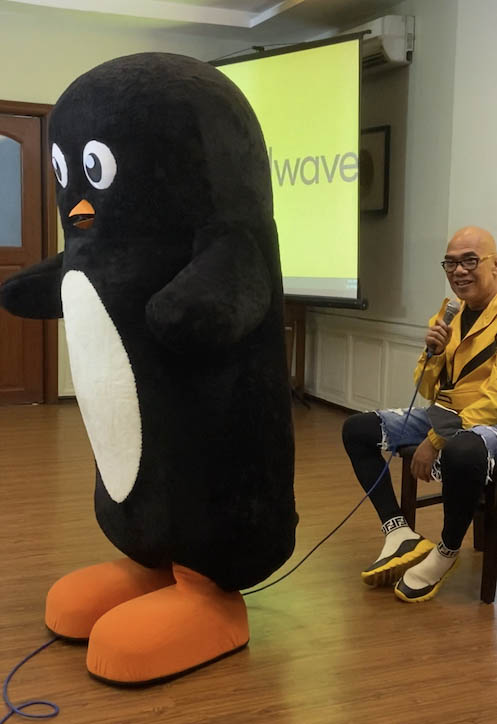

“I know how hard our family and friends work overseas, and how important it is to support our loved ones back home,” says Boy Abunda. “So I’ve been talking with my good friend the Sendwave Penguin and learning how using Sendwave is just as easy and affordable as sending a text message.”

“Now, I don’t like to kiss and tell,” Boy Abunda adds. “But if the penguin asked me, I’d definitely choose Sendwave over chocolates!”

For a limited time, new users in the US, Canada and parts of Europe can use the promo code CHOCOLATE for $10 free credit on their first transfer.

What is Sendwave?

Sendwave is a money transfer app for people in the USA, Canada, and parts of Europe to send money to their loved ones in 22 countries, including the Philippines, with zero remittance fees and near instantaneous transfers.

Sendwave first launched in 2014 and has since expanded to parts of Africa, Asia and Latin America. Nearly one million people have used Sendwave to send over $10 billion to their friends and family.

“The pandemic revealed a need to shift toward more digital options for sending money,” said Dan Santos, Sendwave Growth Manager for the Philippines. “We wanted to help address that for the Filipino community and provide them with a more affordable way to send funds to the people they care about.” Sendwave estimates that it can save the OFW over a $1 billion in remittance fees each year, Santos says.

Sendwave launched in the Philippines in September 2021 in response to Covid-19. “The pandemic was a very unstable time for many overseas Filipino workers, so we wanted to make sure as much of their money as possible is getting to their families, and in the quickest way possible,” says Santos.

The future of cash

Sendwave works by partnering with traditional money transfer methods, like bank transfers or cash collection, as well as digital wallets like GCash. “Digital wallets are really the future, because they are able to quickly and affordably link people around the world, especially in areas where people have not had as much access to traditional banks,” Santos adds.

GCash is the largest digital wallet in the Philippines, with 83 percent of the adult population currently using the service. “Close to 70 million Filipinos are now placing their trust in GCash and we are still growing,” International Remittance Head at GCash Julie Abalos announced earlier this year. “We vow to continue providing reliable service to our customers and innovate to deliver their fintech and lifestyle needs.”

Using the Sendwave app is simple and intuitive. Anyone in the US, Canada and parts of Europe can download it from the App Store or Google Play (look for the Sendwave penguin). After entering your information at sign up, you can select the country you wish to send funds to.

Users can then add a new recipient, select the payout method, and enter the required information for the recipient. After entering the amount you wish to transfer, all you have to do is click the send button, confirm their transaction, and voila! The money is on its way and is generally available to be withdraw within a few minutes or hours, rather than waiting the traditional three days with other remittance services.

You can transfer any amount of money, even as low as $1 (up to $999.99 per day and $2,999.99 per month). Sendwave does not charge any sending fees to the Philippines, though the company makes a small margin from the exchange rate. Other companies can charge as high as $10 to send up to $1,000 from the USA to the Philippines, and can take days for funds to be received.

Getting our Kababayan cash, and giving back

Boy Abunda isn’t the only celebrity endorsing Sendwave. U.S.-based celebrities Rufa Mae, Princess Punzan, Jay R, Ruby Ibarra, Chef Ron Bilaro, and Josie Harrison (Jo Koy’s Mom) all use the app to send money to their families.

Sendwave feels passionately about supporting the Filipino community, not just with easy and fee-free money sending, but also for causes that are near and dear to our hearts. We love making sure other countries get a taste of the Kabayan culture, whether it’s supporting Filipino artists abroad, publicizing Filipino American History months, or raising funds for organizations like FANHS and NaFFAA. Sendwave has funded Typhoon Odette relief and local Save the Children initiatives. So next time your friends or family overseas send you money, tell them to use Sendwave. Use the promo code CHOCOLATE for $10 free credit on your first transfer. With that amount, you can take your favorite person out for a nice lunch, or top off your cell phone so you can call and say thank you to the person who sent you the funds.

Boy Abunda may be the King of Fast Talk, but with Sendwave, you’ll be the King of Fast Cash!